Comprehending LLCs: Trick Info for Business Owners and Company Owner

When taking into consideration the structure of a current or new business, the Restricted Liability Company (LLC) commonly arises as a preferred choice because of its versatility and safety attributes. Unlike companies, LLCs enable a less formal structure and management, making them especially appealing for tiny to medium-sized ventures. The core quality of an LLC is that it combines the limited liability protection of a corporation with the tax effectiveness and functional flexibility of a collaboration. Essentially, what is included in a company's annual report suggests that proprietors (recognized as members) are shielded from personal responsibility for the financial debts and obligations of business, to a certain extent, which is not the case for sole proprietorships or collaborations. This protection is critical in helping members stay clear of individual financial risk if business encounters lawful concerns or bankruptcy.

LLCs are likewise preferred for their pass-through taxation advantages. Unlike a basic firm, where incomes are taxed at both the individual and corporate degrees (causing double taxes), an LLC's revenue is only strained when on the members' personal tax obligation returns. This can cause considerable tax financial savings and simplify the overall process of managing service financial resources. Furthermore, LLCs offer substantial adaptability in management and service procedures. They do not require a board of supervisors, shareholder meetings, or yearly records in most states, which are generally obligatory for companies. what is american eagle's vision statement permits LLC participants to develop their very own methods for running their organization, tailored to their details needs and goals. Moreover, an LLC can have a limitless variety of participants, consisting of people, firms, and even other LLCs, which gives enough space for growth and diversity of service interests.

Understanding the Essentials of Minimal Responsibility Companies (LLCs)

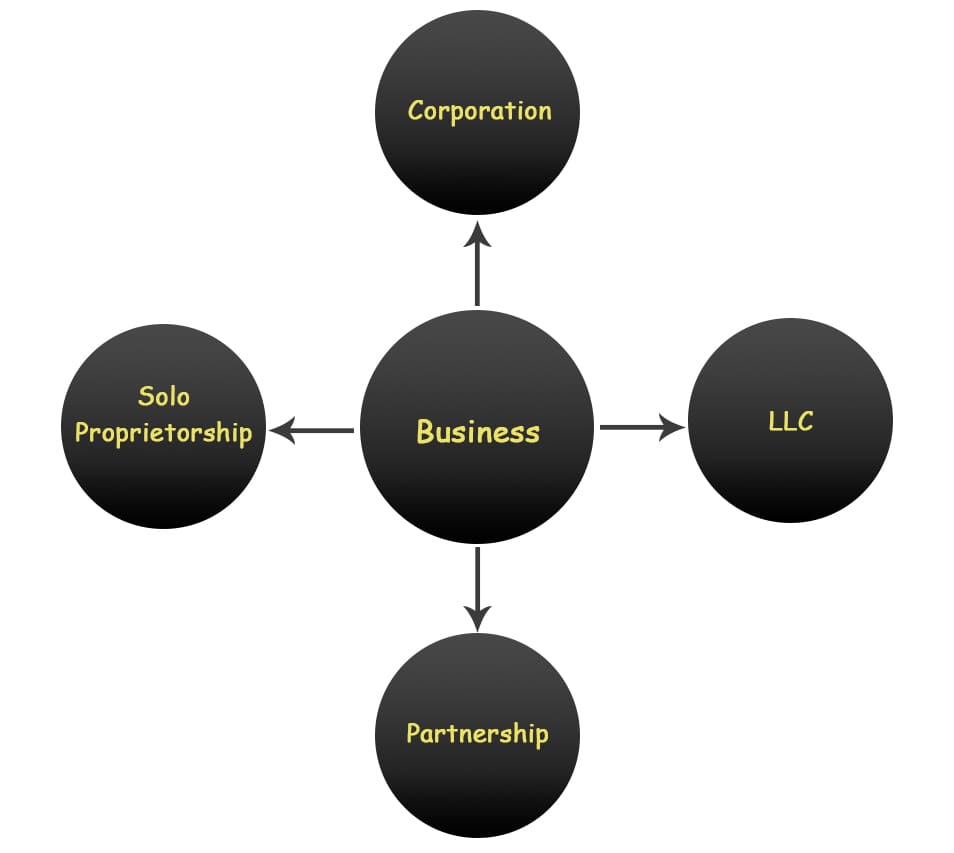

When business owners make a decision to launch a new service, among one of the most critical decisions they deal with involves selecting the appropriate business structure. Amongst the different choices readily available, the Minimal Obligation Company (LLC) has arised as a prominent choice as a result of its versatile advantages. An LLC is a service structure allowed by state law that can secure its owners from individual liability while offering functional adaptability and tax advantages. Proprietors of an LLC are referred to as members, and relying on the jurisdiction, an LLC can have one member (a single-member LLC) or several participants (a multi-member LLC).

Among the principal advantages of an LLC is the protection it offers its members from personal obligation for business financial debts and insurance claims-- an attribute known as 'restricted responsibility'. This indicates that in the instance of personal bankruptcy or legal actions versus the service, the personal assets of the participants, like their home, cars and truck, and financial savings, are generally shielded. One more substantial benefit of the LLC framework is the tax flexibility it offers. LLCs usually take advantage of pass-through tax, where the income of business is treated as the revenue of the participants, hence avoiding the double taxation dealt with by C Companies. LLCs are valued for their operational adaptability. Unlike corporations, which are called for to have an official framework consisting of a board of directors and yearly meetings, LLCs can operate with a lot less formality. They do not need a board of directors, yearly meetings, or business mins, that makes them less complicated and less expensive to handle. Furthermore, the monitoring of an LLC can either be member-managed, where all participants join the service operations, or manager-managed, where only designated managers (who can be members or outsiders) deal with the company events. The process of creating an LLC differs by state, yet typically includes declaring articles of organization with the state's assistant of state and paying a declaring fee. how to register a company in usa online is additionally suggested to produce an operating contract, which describes the possession and operating treatments of the LLC. While this document is not constantly required by regulation, it is crucial in making clear the regulations and assumptions for business and giving a structure for dealing with any type of disagreements among participants. Finally, for entrepreneurs considering versatility, limited obligation, and tax benefits, LLCs represent a compelling choice. They supply a basic yet reliable structure for running an organization while safeguarding individual properties and preventing the complexities of even more stiff corporate structures.

Recognizing Restricted Obligation Business (LLCs)

A Limited Responsibility Business (LLC) is a preferred service structure amongst entrepreneurs because of its versatility and protective benefits. This sort of entity permits the separation in between individual and company obligations, making certain that the personal assets of the owners, commonly referred to as participants, are secured against organization debts and legal activities. LLCs are reasonably simple to preserve and develop, with less conformity needs contrasted to corporations, making them an appealing option for small to medium-sized organizations. Among the vital attributes of an LLC is the capability to pick just how it is tired. By default, LLCs are dealt with as pass-through entities, indicating the organization income is passed via to the participants and reported on their individual tax obligation returns. An LLC can likewise choose to be tired as a firm if this confirms more beneficial. The adaptability extends to administration as well; members can handle the LLC themselves, or they can appoint supervisors to handle the day-to-day procedures. This is specifically useful for members that favor not to be associated with the day-to-day operating of the business yet still wish to take advantage of the LLC's profits and losses. Furthermore, an LLC uses adaptability in terms of membership, as there is no restriction to the number of participants it can have, and it can consist of people, various other LLCs, and even corporations. Establishing up an LLC includes filing write-ups of organization with the state and paying the needed charges, which differ depending on the state. Moreover, while not mandated by every state, it's recommended for an LLC to have an operating contract in position. This agreement details the administration framework and functional procedures, assisting to stop misunderstandings amongst participants down the line. In final thought, the LLC framework offers a combination of liability protection, taxation options, and operational adaptability, making it an engaging selection for many company owner aiming to balance simplicity with formal security.

Comprehending LLC Structures and Workflows

Limited Responsibility Business (LLCs) offer a versatile type of company that incorporates elements of both corporate and collaboration frameworks. An LLC is popular amongst small organization owners due to its simpleness and the security it provides against personal liabilities. Unlike firms, LLCs do not need a board of directors, making them much less troublesome to take care of while still supplying significant lawful protections. The owners of an LLC, who are described as participants, can include people, companies, various other LLCs, and even foreign entities, providing a functional platform for both domestic and international organization procedures. Members of an LLC can select to manage the firm themselves, making it a member-managed LLC, or they can designate supervisors to handle the business procedures, making it a manager-managed LLC. This level of functional versatility allows LLCs to adjust to the certain needs of business and its proprietors, which can be specifically useful for companies that expect adjustments in monitoring or ownership structures. Moreover, LLCs are dealt with as separate lawful entities, which suggests they can acquire possessions, get in into agreements, and sustain obligations individually of their members. This splitting up gives critical range between the participants' individual assets and the liabilities of the business, a significant advantage that can shield people' individual riches from business-related risks. Another vital element of LLCs is their tax versatility; they can elect to be taxed as a single proprietorship, collaboration, S corporation, or C corporation, giving members the ability to maximize their tax obligation obligations based upon their monetary and organization scenarios. This tax obligation flexibility, integrated with the functional adaptability and obligation security, makes LLCs an appealing option for many business owners and entrepreneur wanting to stabilize control with security.

Recognizing the Lawful and Financial Structure of LLCs

When developing a Restricted Obligation Firm (LLC), recognizing its legal and financial structure is essential for making certain compliance and optimizing operational performance. An LLC uniquely blends the attributes of both corporations and collaborations, supplying adaptability in management and the advantage of pass-through tax. This implies that the LLC itself does not pay taxes on service income; rather, the losses and profits are travelled through to individual participants to be reported on their personal tax returns. Legitimately, an LLC is a separate entity that can own building, sustain responsibilities, and enter into contracts. It also supplies responsibility protection to its members, securing individual assets from organization financial obligations and insurance claims. Among one of the most substantial advantages of an LLC is this defense, which is not typically readily available in single proprietorships or collaborations. It is vital to keep the procedures of the LLC structure such as maintaining individual and organization funds different, to ensure that this shield is not compromised. Financially, LLCs have a benefit in that they can select exactly how they are tired, either as a collaboration or as a firm, depending upon which circumstance is a lot more advantageous. This selection can dramatically affect just how much tax the LLC members pay yearly, making it an important choice throughout the initial arrangement of the LLC.